A Simple “Observation” on Trend Watching and Intelligence Gathering

In a growth market, such as online education in the late 1990s and start of millennium, producing products and services is relatively easy or carries with it less risk, as growing market share is the goal rather than stealing share from competitors. Having good intelligence and market research was a luxury back then…to move more swiftly and to leapfrog competition took two steps instead of one. In recent years, many industries are tighter due to a transforming economy and the evolution of new technologies. Launching new products and services, especially in the higher education community, has become more challenging and the need for better, faster intelligence has become essential. Building a process for intelligence into the professional, continuing, and online education unit (PCO)—whether it’s having their own researchers or working with outside consultants—is essential in launching new, sustainable programs.

While one could use the latest greatest occupational forecasts, labor analysis or surveys, one overlooked non-empirical indicator is “observational research.” Among the many tools in the UPCEA Center for Research and Strategy toolbox, next to the portfolio review model wrench and underneath the in-depth employer interview hammer, is the tool of observation. My most recent observation or reflection has been the Consumer Electronics Show (CES), which concluded in mid-January. After reading multiple columns and watching many live web feeds of the event, the following insights can be extracted:

This year’s show featured many products that are maturing, such as personalized robots. Robots have been with society for decades, but their sophistication through artificial intelligence and advancement in engineering coupled with built-in efficiencies is slowly working its way into the consumer household. While largely unsophisticated, the Roomba (designed by iRobot) was introduced to the masses at CES 2014. While gaining some attention, Roomba was in the shadows, as many consumers and the media at CES 2014 were flooded by the push for greater mobility and viewing. CES 2014 had many products that focused on smart TVs, tablets, laptop and cellphones that were adopting 4G technologies. he buzz around self-driving cars was also starting to take place as Audi, BMW and Mazda were demonstrating driver-assisted or “piloted driving” through the migration of more sophisticated radar, cameras, and GPS technologies into the driving experience. Reflecting back a decade to CES 2009, auto manufacturers showcased groundbreaking systems that would help drivers stay in their lanes, consoles that would have Internet access and systems that would allow for satellite entertainment. Much of the automotive technologies showcased in 2009 are common in the middle range auto of 2019.

Trends that should continue to emerge from CES 2019 include further developments in robotics and artificial intelligence (including self-driving cars), alternative fuel systems and electric vehicles, virtual reality and personal assistants (Amazon Alexa, Google Assistant, etc.). The show continues to promote the quality viewing experience, as well the portability through new technologies that leverage 5G connectivity and an 8K viewing experience. This will effect engineering and science curriculums, and business will also be looking toward the future for employees skilled in these areas. The impact will trickle down or domino further into related industries, as it is likely that our cities and municipal places will adapt to different modes of transportation and the new worker.

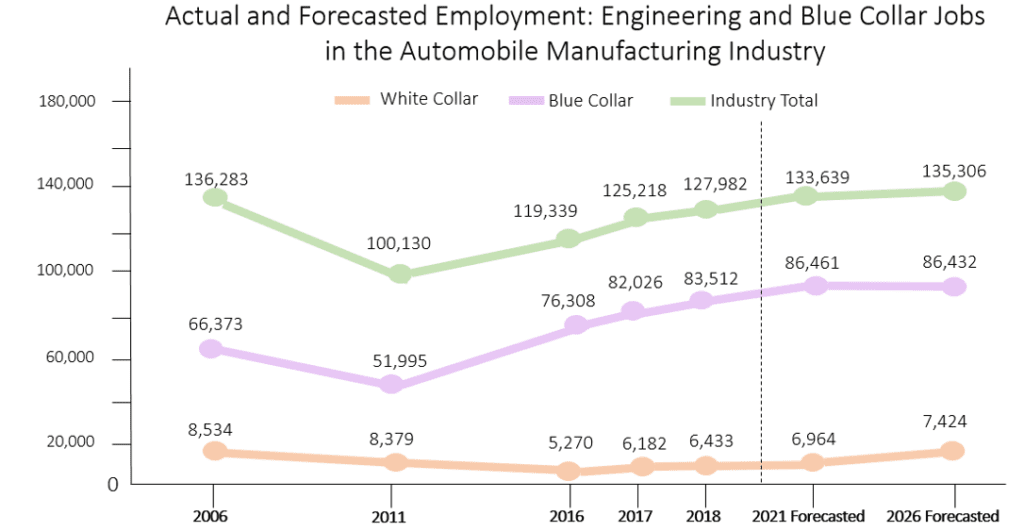

Source: Emsi

Engineering jobs are defined by SOC 17-200

Blue collar jobs are defined as electrical, electronic, and electromechanical assemblers, except coil winders, tapers, and finishers; assemblers and fabricators, all other, including team assemblers; coil winders, tapers, and finishers; first line supervisors of production and operating workers; inspectors, testers, sorters, samplers, and weighers

Looking at the impact of automobile manufacturing, the industry overall has started to recover and projects out favorably over the next decade. The chart above, focused solely on automobile manufacturing (not dealers or distributors), as opposed to the spectrum of motor vehicle or parts manufacturing, shows that employment of engineers (SOC 17-2000) will increase and with it many blue collar professions (electrical, assemblers, tapers, finishers, first-line supervisors, sorters, testers, etc.) within the industry. The industry is seeing a transformation through the integration of artificial intelligence, green fuels and self-driving or driver-assisted technologies. The transformation has forced many manufacturers to close older plants focused on combustion and pivot to the production of more electric vehicles.

Higher education will need to stay in step or ahead of industries in transformation. It can do so through improved intelligence systems or proven market research techniques. While CES is one potential data point for those impacted by trends in consumer electronics, strong advisory panels and market research are others. Higher education, especially those in PCO units, needs a close ear on developments or to be part of the development process by educating the employee based on industry needs and supplementing the education later in life through training and post-graduate education. What higher education institutions can do:

- Strengthen industry ties through advisory committees and long-term partnerships

- Use market research and other modes of intelligence gathering to speed up the needs of identification process

- Identify new degree needs earlier and shorten approval processes while still mitigating risk

Surviving and thriving in a transformative economy is about being relevant for an extended period of time.

Learn more about UPCEA's expert consultants.

Do you need help with your PCO unit or campus? We can help. Contact UPCEA Research and Consulting for a brief consult. Email [email protected] or call us at 202-659-3130.

Trusted by the nation's top colleges and universities, UPCEA Research and Consulting provides the best value in the industry today. UPCEA's industry experts have years of experience in Online and Professional Continuing education - put them to work for you!

UPCEA Research and Consulting offers a variety of custom research and consulting options through an outcomes-focused pricing model. Find the option(s) that best suit your institution.

Learn more about UPCEA Research & Consulting

The UPCEA Difference

Unmatched Experience: For more than 100 years, UPCEA consultants have exclusively served the needs of online and professional continuing education programs. UPCEA consultants leverage their extensive industry expertise to expedite solutions, anticipate upcoming shifts, and offer distinct best practices, effectively aiding clients in achieving their goals.

Cost Effectiveness: As a nonprofit, member-serving organization, we provide unmatched value, allowing you to maximize limited research and consulting budgets.

Action in Motion: Our cadre of experienced, skilled authorities and expert practitioners propels you forward, translating research and consulting into impactful implementation, a distinctive hallmark of UPCEA. Our team of current and former institutional leaders will support you, turning research and consulting into action.

Mission Alignment: Like you, our mission is to enhance and expand educational opportunities and outcomes for adult and other non-traditional learners. We share your values and work in partnership with you to advance access and excellence in education.